|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

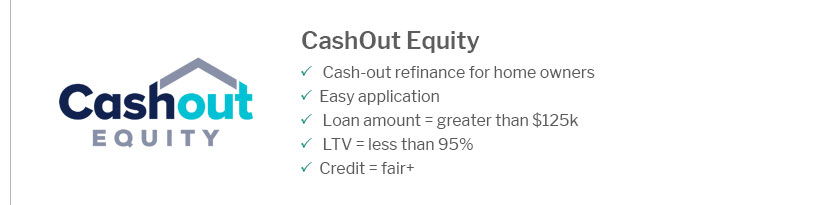

Understanding Home Loan Refi Rates: A Comprehensive GuideWhat Are Home Loan Refi Rates?Home loan refi rates, also known as refinance rates, refer to the interest rates applied when refinancing an existing home loan. Refinancing involves replacing your current mortgage with a new one, often to take advantage of lower interest rates or to adjust the loan term. Factors Influencing Refi RatesCredit ScoreYour credit score plays a significant role in determining the interest rate you receive. A higher credit score typically results in a lower interest rate. Loan-to-Value RatioThe loan-to-value (LTV) ratio is the amount of the loan compared to the value of the property. A lower LTV ratio can lead to better refi rates. Market ConditionsInterest rates fluctuate based on economic conditions, including inflation, employment rates, and the Federal Reserve's monetary policy. Types of Refinancing Options

When choosing between conventional loan vs fha loan refinance, understanding the specific benefits and limitations of each option is crucial. Pros and Cons of RefinancingBenefits

Drawbacks

FAQs

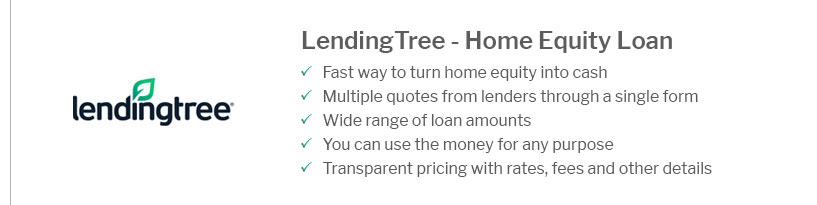

Another refinancing option to explore is the credit equity home line refinance, which allows for borrowing against the equity in your home in a flexible manner. https://better.com/refinance-rates

Refinance rates - 30-yr fixed. Rate. 6.750%. APR. 6.954%. Points (cost). 2.06 ($3,291). Term. 30-yr fixed. Rate - 30-yr fixed FHA. Rate. 6.250%. APR. 6.453% ... https://www.uwcu.org/rates/mortgage-refi/

Rapid Refinance 8 Year Fixed** - $13.27 - 6.250% - 6.266% ; Rapid Refinance 12 Year Fixed** - $10.09 - 6.625% - 6.636% ; 15 Year Fixed** - $8.64 - 6.375% - 6.454%. https://www.ally.com/home-loans/refinance-mortgage/

Customized mortgage rates ; 7/6 ARM, 8.000% (7.962%), $6,543 - $2,568 ; 15-year fixed, 6.625% (6.626%), $25 - $3,073 ; 30-year fixed, 7.250% (7.254%), $133 - $2,388 ...

|

|---|